Stocks on Thursday dropped for the second session to hover under 89,000 points as a massive correction interrupted a days-long rally, which was mainly fuelled by the expectations that the central bank was set to extend its hawkish monetary policy on November 4.

The Pakistan Stock Exchange’s benchmark KSE-100 Shares Index lost 1319.80 points or 1.46% to hit a low of 88,966.76 points against the previous close of 90,286.56 points.

Analysts are blaming institutional profit-taking in overbought scrips as the main reason behind this downward spiral that started yesterday as on Wednesday equities slumped 577.52 points or 0.64% to 90,286.57 points owing to selling pressure at the tail-end of the ongoing earnings season.

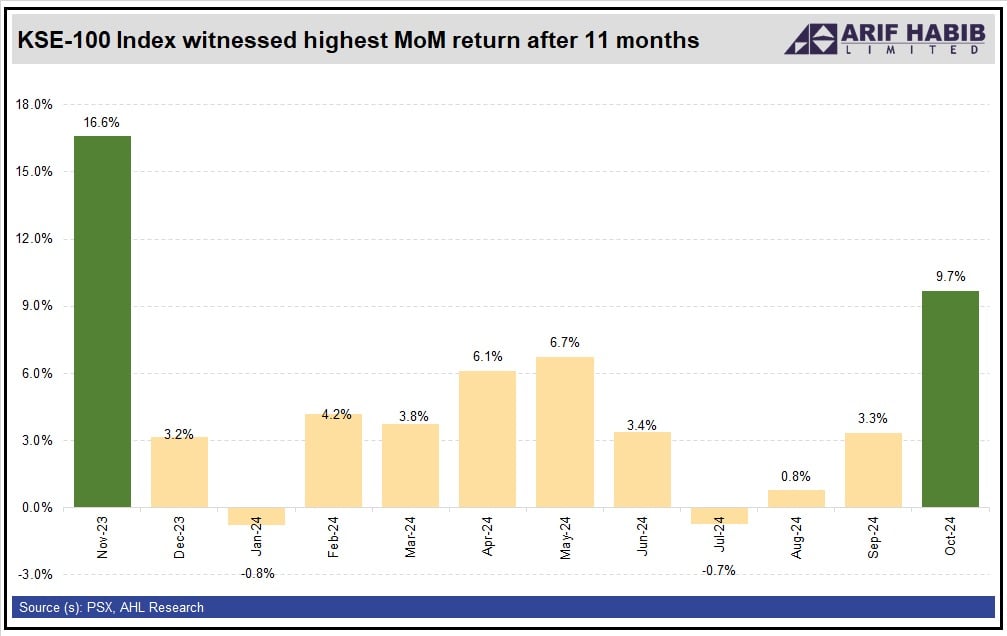

Brokerage Arif Habib Limited (AHL) in a note said the KSE-100 index surged by 9.7% (+7,853 points) on a month-on-month basis in October 2024, closing at 88,967 points — its highest monthly return since November 2023.

Samiullah Tariq, the Group Head of Research and Product Development at Pakistan Kuwait Investment Company (Private) Limited (PKIC), noted that the market was experiencing an expected breather. “Such corrections are typical in financial markets, allowing for consolidation before potential future gains,” Tariq added.

Moreover, foreign outflows, rising industrial gas tariff, rupee instability and concerns for the outcome of Saudi investors seeking guarantees over stable government policies for a $2 billion investment also dented the sentiment.

Commenting on the plunge, Ahsan Mehanti at Arif Habib Corp said Stocks fell sharply on institutional profit-taking as the earning season was coming to a close after many robust corporate financial results announcements by various big names.

“Rupee instability and uncertainty over State Bank of Pakistan’s decision on key policy rates ahead of International Monetary Fund’s first review on extended fund facility weighed the stocks down,” Mehanti added.

On Wednesday, the rupee weakened for a third consecutive session owing to persistent demand for dollars by importers, closing at 277.79 per dollar in the interbank market.

The financial market anticipates that the State Bank of Pakistan (SBP) will reduce its policy rate by up to 200 basis points in its upcoming meeting on November 4.

If implemented, this would mark the fourth consecutive rate cut since June, driven by declining inflation, a narrowing current account deficit, and increased workers’ remittances.